Frequently Asked Questions on Importer-Exporter Code (IEC)/(E-IEC)

EPCG stands for Export Promotion Capital Goods. The objective of this scheme is to facilitate the import of capital goods with the purpose of producing quality goods and services to enhance India’s export competitiveness. EPCG scheme allows the import of capital goods for pre-production, production, and post-production at zero customs duty.

YManufacturer exporters with or without supporting manufacturer(s), merchant exporters tied to supporting manufacturer(s) and service provider(s); and service providers. Refer to FTP and HBP for the latest details.

- Your user profile must be linked with an IEC.

- A valid DSC / e-sign must be registered in the system. You may verify the same from My Dashboard > View and Register Digital Signature Token.

- GSTN details correspond to the branches of the IEC. The same may be added from Services > IEC Profile Management > Modify IEC.

- Valid RCMC details issued to the IEC.

If your IEC is in DEL, you shall be allowed to proceed with the submission of your request for issuance of an EPCG authorization, however, your application shall only be actioned upon once your IEC is removed from DEL.

Refer to FTP and HBP for the latest details. The export obligation under the Export Promotion Capital Goods Scheme is required to be fulfilled by the export of goods/services rendered by you. There are two types of export obligations that the authorization holder is obligated to complete:

- Annual average export obligation: The export obligation is over and above, the average level of export achieved by you as an authorisation holder in the preceding three licensing years for the same and similar products within the overall export obligation period including the extended period (if any). Such an average would be the arithmetic mean of export performance in the previous three years for the same and similar products.

- Specific export obligation: Specific export obligation is calculated as six times the duty saved amount. You must fulfill a minimum of 50% of export obligation in each block of years, i.e., the first block being the first 4 years and the second block is of the remaining 2 years.

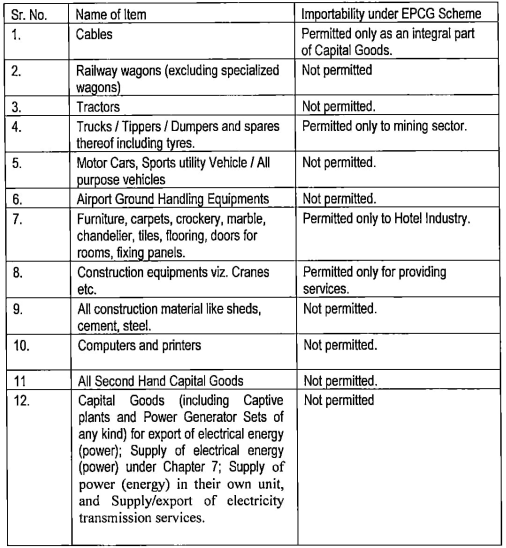

Capital Goods for the purpose of the EPCG scheme shall include:

- Capital goods as defined in Chapter 9

- Computer systems and software which are a part of the capital goods

- Spares, molds, dies, jigs, fixtures, tools & refractories

- Catalysts for initial charge plus one subsequent charge

Please follow the below steps to check the status of a submitted application for EPCG

- My Dashboard > Submitted Applications

- Enter the Type of Scheme (Select in the dropdown: Export Promotion Capital Goods (EPCG)) and Type of Sub Scheme (Issuance of EPCG Authorisation/Post-Export EPCG Authorisation)

- Click on Search

- In the search results, please find the status of the submitted application under the column File Status

You can export either directly or through a third party(s). Export proceeds are to be realized in freely convertible currency except for deemed exports. Import of capital goods imported under the EPCG scheme shall be subject to Actual user conditions until the export obligation is completed.

Post Export EPCG Duty Credit scrip(s) shall be available to exporters who intend to import capital goods on full payment of applicable duties, taxes, and cess in cash and choose to opt for this scheme.

- The basic customs duty paid on capital goods are remitted in the form of freely transferable duty credit scrip(s) under this scheme. This script shall be similar to that issued under Chapter 3 of FTP.

- The specific export obligation shall be 85% of the applicable specific export obligation under the EPCG scheme. However, the average export obligation shall remain unchanged.

- The duty remission shall be in proportion to the EO fulfilled.

- All provisions for utilization of the duty credit scrip(s) shall be applicable to Post Export EPCG Duty Credit Scrip(s) as under Chapter 3 of FTP.

- All provisions of the existing EPCG scheme shall apply in so far as they are not inconsistent with this scheme.

To avail of benefits under the Post Export EPCG Duty Credit Scrip, please follow the below steps:

- Services > EPCG

- Click on Apply for EPCG/Post Export EPCG authorization

- Now apply for the issuance of a post-export EPCG authorization by choosing Post Export EPCG under the Application for the field.

- Post issuance of the authorization, start with your exports against the authorization number issued to you.

- After completion of your exports, you may apply for the issuance of a Post Export Duty Credit Scheme by proceeding for Closure.

Please follow the below path to apply for the issuance of an EPCG/Post Export EPCG authorization:

- Services > EPCG

- Click on Apply for EPCG/Post Export EPCG (ANF – 5A)

You may complete your export obligation by the export of either services or products. While applying for the issuance of the authorization, you must select whether the item of export is a service or a product against each item of export.

Yes, you may import/export multiple items that are of the same or similar nature, under a single EPCG authorization.

Imports under the EPCG authorisation shall be subject to an export obligation equivalent to six times the duties, taxes, and cess saved on the capital goods, to be fulfilled in six years reckoned from the date of issuance of the authorisation.

EPCG authorisation shall be valid for imports for 18 months from the date of issuance of the authorisation.

Following is the list of documents/attachments that are mandatory to apply for the issuance of an EPCG authorisation:

- Self-certified copy of MSME/IEM/LOI/IL in case of products or a self-certified copy of Service Tax Registration in case of Service Providers.

- Certificate from a Chartered Engineer in the format given in Appendix 5A.

- Certificate from a Chartered Accountant/Cost Accountant/Company Secretary in the format given in Appendix 5B.

- In case of Import of spares, tools, refractories, and catalysts for existing plant and machinery, a list of plant/machinery imported and already installed in the factory/premises of the applicant firm/ supporting manufacturer for which the above items are required, duly certified by a Chartered Engineer or jurisdictional Central Excise authority.

- In the case of EPCG applications made by EOU/SEZ units, a self-certified copy of the ‘No Objection Certificate’ from the Development Commissioner concerned showing the details of the capital goods imported/indigenously procured by the applicant firm, its value at the time of import/sourcing and the depreciated value for the purpose of assessment of duty under the Scheme is to be submitted.

You may add new items, increase or decrease the number of items, duty saved/duty paid amounts, modify the UOM, Nature of capital goods sought to be imported, and the Primary use of the capital goods, request for transfer of capital goods from.

Please follow the below steps to request for an amendment to the authorization:

- Services > EPCG

- Click on Amendment of fields of EPCG Authorisation

- Select the authorization for which the modification is proposed from the list given.

Please note that a fresh nexus certificate signed by a Chartered Engineer shall be required on the addition or deletion of items to the import or export list.

Please follow the below steps to request EO extensions to the EPCG authorisation issued to you:

- Services > EPCG

- Click on Apply for EO/Block Extension

- Select whether the application is for a block-wise extension or an extension of the EO Period in the field Application for.

- Select an authorisation from the list of authorisation given Clubbing

Please follow the below path to apply for clubbing of two or more EPCG authorisations:

- Services > EPCG

- Click on Clubbing of EPCG authorisation (ANF – 5C)

Steps to apply for closure of EPCG authorisations or issuance of Post export EPCG duty credit scrips:

- Services > EPCG

- Click on Closure of EPCG authorisation (ANF – 5B)

Please follow the below path to apply for closure of EPCG authorisations or issuance of Post export EPCG duty credit scrips:

- Services > EPCG

- Click on Closure of EPCG authorisation (ANF – 5B)

- Choose to apply for redemption/regularization/surrender of an issued authorisation or issuance of Post export credit duty scrips

- Select an authorisation from the given list of authorisations.

Apply for EPCG / Post export EPCG

Amendment of Fields of EPCG Authorisation

Invalidation/Certificate of Supplies of EPCG Authorisation

Clubbing of EPCG Authorisation

Closure of EPCG / Issuance of Post export Scrip

Installation certificate

Apply for EO / Block Extention

Apply for EPCG Committee

(2).jpg)